|

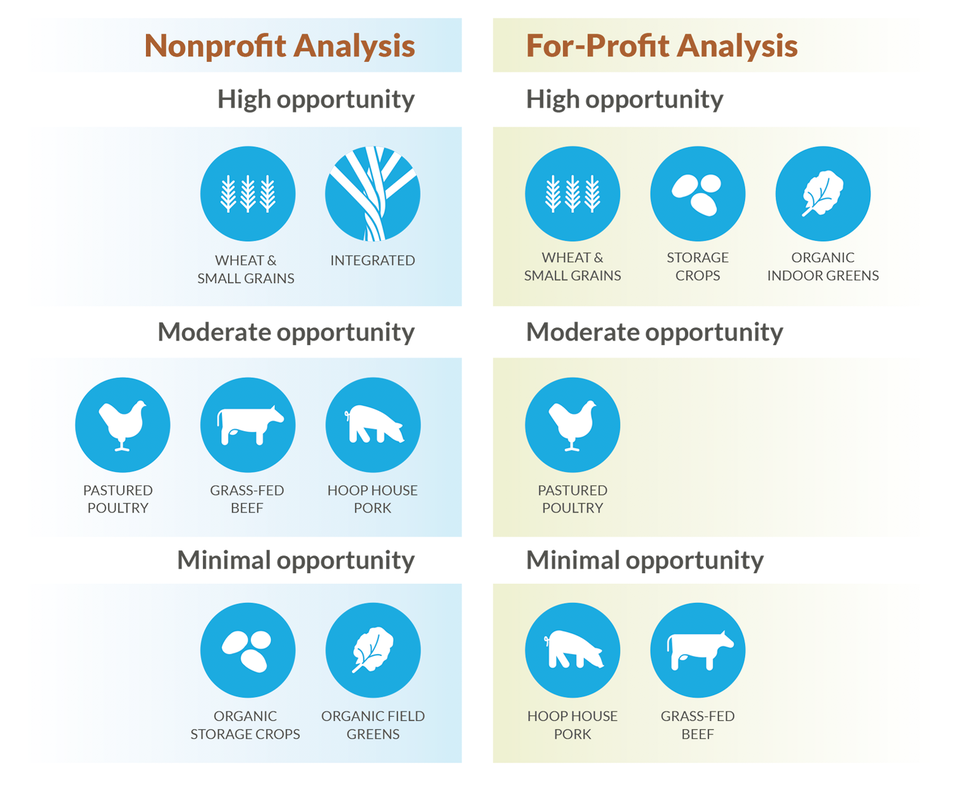

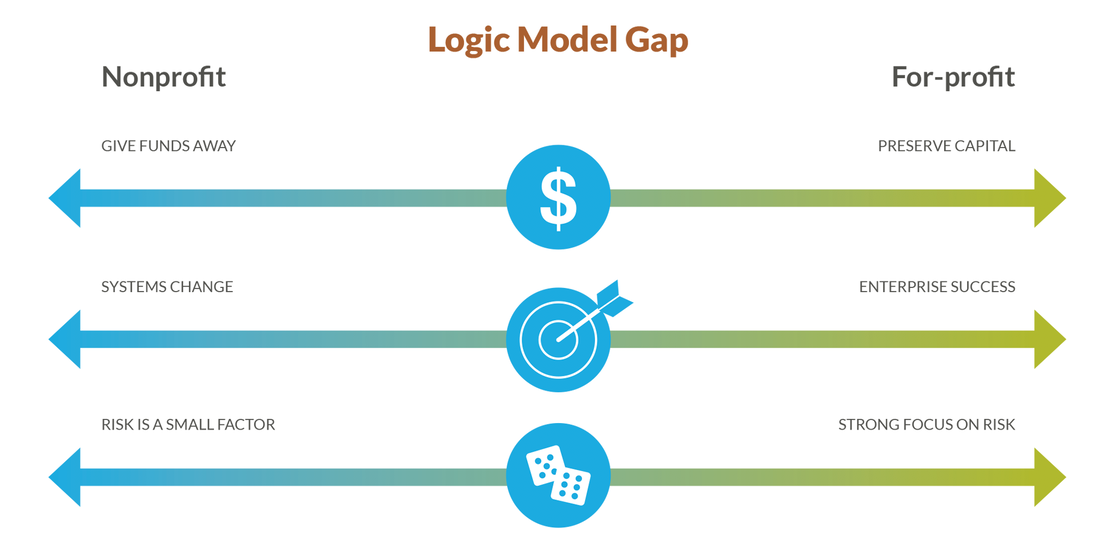

What happens when philanthropy meets the profit motive in sustainable food investing? This is a short summary of what CFFP uncovered when traditional investors joined philanthropists to invest in sustainable food systems. Our group includes foundations and impact investors in the U.S. states of Washington and Oregon. We all came to the table in support of “investment” as a tool to create sustainable food systems. But it took a few years to find a common vision for the investing work. What took so long? We think it is because our philanthropists and traditional investors have very different experiences with money, risk and achieving success. These experiences create what we call for-profit and non-profit “logic models” that can shape widely divergent expectations of the investing activity. CFFP found a path forward on investing that reconciled our for- and non-profit mindsets. We offer our thinking on the logic gap to help other collaborative groups move forward toward investing in sustainable food systems. In early 2016 CFFP hired Ecotrust, a high-functioning regional non-profit, to research market factors in six food sectors: beef, poultry, pork, small grains, leafy greens and storage crops. The goal was to identify sustainable production models already in use, identify the market drivers and investment opportunities, inform outreach to potential financiers, and determine whether a dedicated fund should be established in Washington and Oregon. CFFP hoped to align different types of capital around the findings of the Ecotrust report. The full market research successfully identified sustainable production models currently in use along with specific supply and demand drivers for each product. However, when presented with the same information, non-profit and for-profit investors had different conclusions on how the collaborative should proceed. Ecotrust had made its recommendations as a non-profit investor. It focused on opportunities that could transform the actual system of food and agriculture, especially those working on overarching sustainability goals and crossing product lines. For example, no-till grains can generate grain and improve soil health and sequester carbon and be used for chicken feed. In contrast, Mark Bowman, a seasoned agricultural lender, analyzed the same data as a for-profit investor. He emphasized investment repayment factors: production costs, potential linkages and gaps for investors, industry trends, business configuration and entrepreneur expertise. Surprised, CFFP partners discussed the divergent recommendations and what they meant for the group’s next steps. Foundations tend to fund for transformational system change, they observed, while for-profit investors seek to “pick winners” based on transactional financial success. In other words, non-profit audiences reading the report sought opportunities to transform the overall food system, while for-profit investors looked for enterprises with the best chance of repaying their investments.

“It was described as a difference between a utopian ‘I want to change the world’ view to a ‘what’s actually going to provide some returns?’ view,” said Mauri Ingram, Whatcom Community Foundation CEO, who praised Tim Crosby, Project Coordinator, for having the research evaluated from both points of view. The logic model gap between non-profit and for-profit investors needs to be acknowledged and overcome, CFFP members agreed, for any project seeking to bring funders together for maximum community benefit — not only for investing in a regional food system, but for any issue area, in any geographic footprint.

0 Comments

|

LearnAs part of its own research, CFFP regularly illuminates educative research, media, and resources related to our work. This page contains public versions of our synopses. Archives

June 2019

Categories

All

|

© Cascadia Foodshed Financing Project 2016

1521 10th Pl N, Edmonds, WA 98020 | (206) 300-9860 | [email protected]

1521 10th Pl N, Edmonds, WA 98020 | (206) 300-9860 | [email protected]

RSS Feed

RSS Feed