|

by Haley Millet The Cascadia Foodshed Financing Project periodically reviews and summarizes reports relevant to its work. Here, we discuss key takeaways from KL Felicitas Foundation’s portfolio-wide evaluation report, “Investing For Impact: Practical Tools, Lesson, and Results.” After coming into wealth in Silicon Valley during the dotcom boom of the 1990s, Lisa and Charly Kleissner founded the KL Felicitas Foundation with the groundbreaking goal of developing a portfolio dedicated to social return on investment. Today they continue to refine their own portfolio and, through groups like the 100% IMPACT Network, help others achieve similar goals. But fifteen years later with investments spanning a wide variety of locales, sectors and financial mechanisms, the Kleissners wondered: how can the foundation know for sure that its investments are having the desired social impact? KL Felicitas asked charity consultant New Philanthropy Capital (NPC) to conduct a third-party impact evaluation of their investment portfolio to find out. The resulting report, “Investing For Impact: Practical Tools, Lesson, and Results,” (November 2015) reveals that with complex work comes complex evaluation. It is clear that no single evaluation approach can accurately represent the outcomes of diverse KL Felicitas investments. However, an evaluation approach using several different lenses provides perspective on success and room for improvement. This work presents useful implications as we at Cascadia Foodshed Financing Project, immersed in the more targeted but equally complex business of food systems impact investing, constantly revisit our own methodologies. “At CFFP we utilize a lean startup framework,” said Tim Crosby, CFFP Project Coordinator. “Part of this framework involves revisiting core assumptions, workplan, and other key functions, and then pivot those functions as needed to accommodate emerging understanding of the work.” NPC measured the impact of the foundation’s work along two veins:

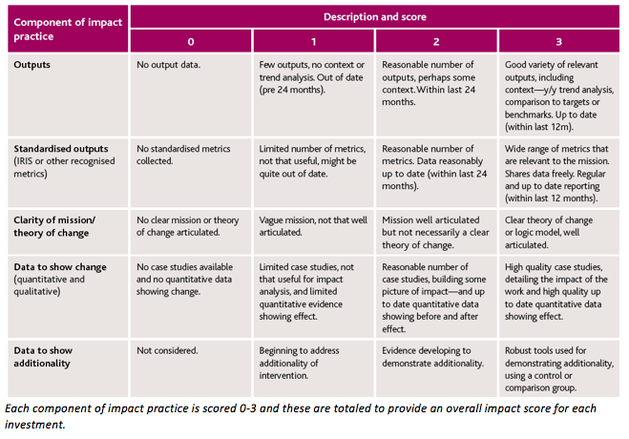

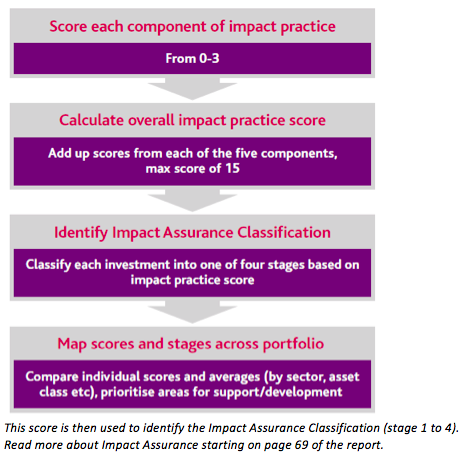

Impact of the Investment Portfolio 1. NPC explored seven of the individual investments within the KL Felicitas Foundation’s in a case study format, presenting narrative and metrics appropriate to each investment. This approach provides an opportunity for storytelling, an unconventional but compelling means of investment evaluation that may not describe the big picture, but provides qualitative and quantitative insights into what those investments have accomplished on the ground. As CFFP completes our market research and begins outreach to businesses and investors, storytelling will help to communicate our approach, leverage our research and build strong relationships with strategic players. 2. Next, in order to aggregate impact across the whole portfolio NPC developed a new framework known as Impact Assurance Classification. The classification is described as “a starting point to compare the quality of impact practice of investments across asset classes, sectors, and eventually financial returns.” Essentially, the classification assesses the quality and robustness of impact data produced by the investees, based on the belief that a developed, intentional measurement process increases the probability of achieving that impact. Investments are scored based on outputs, standardized metrics, clarity of mission, data to show change, and data to show additionality. The end result allows an investor to compare investments within a portfolio regardless of the measurement process used by the investee. Below are a couple of graphics from the report that help explain how the Impact Assurance Classification functions. The Kleissners felt that this classification process worked better than others methods, including IRIS, a catalog of generally accepted performance metrics, because it gave Felicitas more flexibility to compare different investments against each other and their overarching goals. “What we have learned is that it is still very difficult to coax investees to use IRIS or to use it correctly. However, the good news is that the Impact Assurance evaluation process allows us to translate any impact measurement method used into a value we can compare with other investments. This flexibility is invaluable for a portfolio investor like us.”

“Investors increasingly want to understand the social return of their investments — but unlike measuring financial performance, there is no single metric that can be compared across investments in different asset classes, geographies, sectors etc.,” added Plum Lomax, from NPC. “Our Impact Assurance Classification begins to address this— we also hope it will encourage investees to improve their impact practice and draw new investors into the field through increased transparency of returns.” 3. NPC’s third evaluation method focuses on specific investment themes that include community development, energy, food/agriculture, ecosystem management & conservation, and financial services. Such themes are akin to CFFP’s guiding principles of Health, Social Equity, Family Wage Job Creation and Preservation, Rural Community Resilience, and Ability to Influence Policy in the realm of food systems. Thematic investments "focus on issue areas where social or environmental needs offer commercial growth opportunities for market rate return.” In contrast, impact-first investments place “emphasis on the optimization of social or environmental needs which may result in financial trade-off.” While the portfolio was analyzed this way, NPC found interesting trends between thematically-focused investments versus impact-first investments. On average, KL Felicitas impact-first investments had higher impact assurance ratings than purely thematic investments. This trend is supported by lessons CFFP has learned from those who have gone before us. Craft3, an aligned Community Development Financial Institution in the Pacific Northwest, has admonished CFFP to have a crisp sense of what to say no to – and an even crisper sense of what is OK, but not great. Craft3 relayed how some of their investments only aligned with one or two of their thematic investment goals (e.g. Women in Business, Environmental Sustainability). However, those impact-first investments, even when thematically weak, created ripple effects throughout the local communities in which those businesses exist. Impact of the Foundation’s Movement-Building Work While analyzing the impact of the investment portfolio, NPC also looked at the foundation’s efforts to build an international movement around impact investing. The foundation works to foster “an impact investing ecosystem” with three main aims: to grow the number of social entrepreneurs, to grow the number of impact investment intermediaries, and to grow the number of impact investors. These aims are advanced by equipping others to join the impact investing movement through the support of social enterprise accelerators, support of the first impact fund managers and firms, creation of standardized metrics for impact investment, and facilitating investor networks. Some of the achievements in movement building thus far include four new accelerator startups, $497 million in assets managed jointly through Felicitas-related intermediaries, and 738 members connecting via Felicitas-related networks. Lessons Learned The Kleissners shared key takeaways from this dynamic evaluation process with CFFP Coordinator Tim Crosby. Their insights highlight not only approaches to evaluation, but driving factors behind their investment approach as well:

Implications for Impact Investment Overall, NPC’s multi-lens approach to evaluation of the KL Felicitas portfolio presents some interesting possibilities for CFFP’s own evaluation model, however preliminary at this stage. The highlighting of individual investment stories, the amalgamation of diverse measurement tools within a common framework, and the focus on thematic but high-impact investments are all useful strategies to consider as we move forward. Evaluation is an important tool in the fields of finance, philanthropy, and government work alike. An innovative approach will not only help to measure CFFP’s progress towards our goals, but communicate our stories to others with a desire to join the food systems impact investment effort. Comments are closed.

|

LearnAs part of its own research, CFFP regularly illuminates educative research, media, and resources related to our work. This page contains public versions of our synopses. Archives

June 2019

Categories

All

|

© Cascadia Foodshed Financing Project 2016

1521 10th Pl N, Edmonds, WA 98020 | (206) 300-9860 | [email protected]

1521 10th Pl N, Edmonds, WA 98020 | (206) 300-9860 | [email protected]

RSS Feed

RSS Feed